Outsourced Accounting: Essential FAQs Answered : Cherry Bekaert

In this guide, we’ll show you the areas you can outsource and help you pick the best experts for the job, so you can get back to doing what you love. Outsourcing your accounting and financial admin can unload some of that burden. You know, those times of the year when coffee becomes your best friend and the office practically turns.. Learn how to build and maintain a balanced team with these 4 essential management strategies for creating a… Get in touch with one of our experts and see how outsourcing can fit into your accounting strategy. We recognize the vital role of uninterrupted accounting operations in your business’s smooth functioning.

Small to medium-sized businesses

Once you’ve established what you want to outsource, the next next step is to identify who you’re going to outsource it to. If you’d like to outsource some or all of your accounting obligations, here’s how to get started. As well as helping you comply with all relevant laws, this ensures that you are fully prepared if your company gets audited.

Financial Accounting Standards Board (FASB)

- A beginner’s guide to the expense report, a form businesses use to track and reimburse employee expenses.

- This is why many companies look into DIY accounting systems such as QuickBooks or Xero.

- Suppose you have decided against outsourced accounting and have opted to tackle the financial responsibilities of your small business yourself.

- However, this might not be cost-effective and, as your company grows, it might not be scalable either.

- But preparing taxes and complying with regulations can be tricky, especially if your business has a complex corporate structure.

The day you hire your first employee, you become responsible for payroll tax. The entities falling under the Cherry Bekaert brand are independently owned and are not liable for the services provided by any other entity providing services under the Cherry Bekaert brand. Our use of the terms “our Firm” and “we” and “us” and terms of similar import, denote the alternative practice structure of Cherry Bekaert LLP and Cherry Bekaert Advisory LLC.

Loss of control over accounting processes

A beginner’s guide to the expense report, a form businesses use to track and reimburse employee expenses. Derek Gallimore has been in business for 20 years, outsourcing for over eight years, and has been living in Manila (the heart of global outsourcing) since 2014. Derek is the founder and CEO of Outsource Accelerator, and is regarded as a leading expert on all things outsourcing. An insider’s view on why remote and offshore staffing is radically changing the future of work. These organizations work with several different companies and individuals, requiring liquidation how to find and get a small business grant and proper documentation for law compliance.

A guide to outsourced accounting: All you need to know

In-house accounting involves hiring and net realizable value definition training internal staff to handle financial tasks. Outsourced accounting relies on external experts who are already equipped to manage a businesses’ financial operations. You might say that areas of accounting and bookkeeping must be done internally due to the job’s sensitivity. But with outsourced accounting, your financial statements and compliance tasks are all safe and secure, as providers are equipped to handle sensitive data and maintain work quality. By leveraging accounting firms’ specialized knowledge and resources, businesses can optimize their financial management and achieve long-term success.

Since several companies are transitioning to a more hybrid or remote work model, outsourced accountants are much needed in smaller businesses and organizations. This scalability ensures that organizations have the necessary accounting support without the burden of hiring and training additional staff or reallocating internal resources. Accounting firms offer flexible pricing models, allowing organizations to pay for the specific services they need, reducing overall overhead costs. Outsourced accounting is when an organization delegates its accounting and financial functions to an external third-party service provider. First, analyze your accounting operations and determine which functions you’d like to outsource.

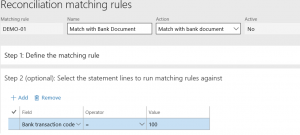

With access to real-time financial data from virtually anywhere, these technologies make collaboration easier and more efficient. Outsourced accounting occurs when a business hires an external, third-party company to handle its finance and accounting functions. These functions can include managing payroll, accounts payable, accounts receivable, monthly bank reconciliations, tax prep support, legal compliance and financial reporting, among others. The financial service packages you can hire out will depend upon the entity you are working with. It is best to research the individual accountants and bookkeeping services offered around you, with those provided by small, medium, and large accounting firms. Typically, an outsourced accounting service can provide full coverage of all accounting and financial services for a company.

We can also help ensure that you are filing the right tax paperwork, including contractor paperwork. Almost all companies must pay taxes on their income, regardless of where they are headquartered. But preparing taxes and complying with regulations can be tricky, especially if your business has a complex corporate structure. Explore the role of FASB in financial reporting, including its mission, standards, and collaboration for consistency in accounting practices. As the owner, you want to grow your 10 basic tax terms you should know business and focus on the vision of the company itself. It’s dead-simple to use and makes those intimidating tasks feel relatively straightforward.