How to Calculate Vacation Accruals + Free PTO Calculator

They can also set it so only a subset of employees have access to a certain time off type. This is useful if you want to add work-from-home days, or additional personal days are needed for certain employees. Lastly, our automatic breaks feature lets managers set up a predetermined time for breaks, and set the amount of time for breaks.

Accountability to the extent that employees are accountable to take their planned time off in accordance to time off being taken by other employees. You see, only 12 states, along with Washington DC, presently have constituted vacation accrual programs. However, they only have the vacation accrual policies that overtly say that state-mandated time off is used for things other than illness.

Factors that can affect PTO accrual rates

Traditional vacation accrual, lump-sum PTO, unlimited PTO, and flex time all work differently. Adjusted for inflation, it takes 25 to 47 minutes and costs $23.37 to $46.43 to calculate and update the PTO balances for a single employee. This article dives deeper into those costs and breaks them down by number of employees. Automatic accruals through our platform are reliable, trustworthy, and instant––saving you 25 to 47 minutes and $19.19 to $38.13 per employee every time you need to calculate accruals. If you’re doing 4,000 data entries by hand every time you run payroll, the data shows that you’re going to make 640 errors. Each error will change your company’s knowledge of its floating PTO liabilities, materially impacting your company’s financial statements.

Vacation time, paid time off, paid leave, vacation accrual, and accrued pay, it can all get very convoluted and frankly, very confusing. Additionally, Vacation pay is a percentage of the eligible wages earned by an employee during each year of employment. For every week of vacation time an employee is entitled to, you must pay them 4% of their “vacationable” earnings.” (Enkel). Accrued vacation pay isn’t paid the same way for every employer, and this provides an advantage for employers. Allowing your company to pay vacation or leave time in different ways is useful for payroll purposes.

Step 5: Use the Correct Accrual Rate per Cycle

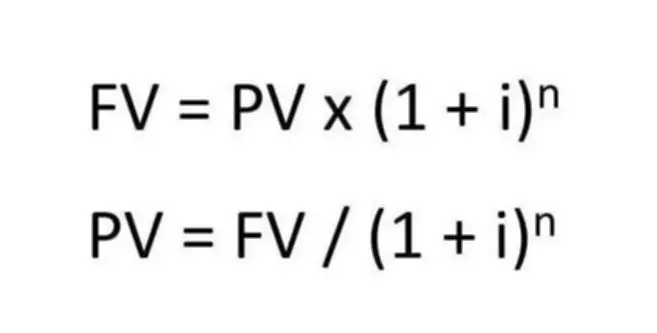

Acquiring knowledge of how to accurately account for employees’ accrued vacation time under Generally Accepted Accounting Principles (GAAP) is essential for every business owner. It’s often based on the number of hours or weeks an employee works in the requested period; for example, some employers may offer one accrued vacation meaning extra day of accrued vacation each month. When the employee uses vacation days, you must reverse the accrual in your books with an additional journal entry. Evaluate your vacation accrual methods at least once per year to ensure accuracy, and account for any changes in pay rates or unused vacation time.

- Without this step in place, you’re not going to get accurate accruals.

- Lastly, our automatic breaks feature lets managers set up a predetermined time for breaks, and set the amount of time for breaks.

- The accounts you debit and credit depend on if the vacation is accrued or used by the employee.

- Many employers provide vacation time to employees, but employees might not use their earned vacation right away.

- Additionally, a PTO balance cap is when an employee accrues the maximum number of PTO hours available to them for a set time period and is no longer able to accrue any additional PTO hours.

- This is because, if the employee were to leave the company and be paid all of his unused vacation pay, he would be paid at his most recent pay rate.

Annual leave accrual, however, is something employers frequently misunderstand. Many people assume that employees are immediately entitled to their annual leave once they join a company. Lastly, you should consider any rollover policies that apply to any leftover hours. Many employers require their employees to use their paid time off within a calendar year i.e. between January and December of a given year.

Can Salaried Employees Receive Comp Time?

However, rollovers with expiration can still create resentment amongst employees who feel like they’re being cheated out of something they’ve earned. Semimonthly PTO accrual grants paid time off twice per month, while biweekly accrual grants PTO every two weeks. Biweekly and semimonthly PTO accrual are the most popular choices, because they align with a typical payroll schedule. But if you are not ready to use a simple software on Slack or Teams yet, calculating vacation accrual is actually pretty easy for a few employees. Employers also have the authority to divide their PTO into different categories like personal leaves, sick days, or vacation. US Federal Law does not require every company in the U.S. to offer PTO to employees.

- Once their lump sum is given; they don’t add PTO with more time worked.

- They can also set up automatic approvals for specific employees or dates, saving them time from manually approving requests.

- Say the same employee wants to use 5 hours of accrued vacation time.

- Use the following steps to determine the employee’s gross wages for accrued vacation time.

- Accrued PTO is a formula that determines how much PTO is earned over a given period of time.

- Often, salaried employees are granted a fixed rate of paid time off based on their average workweek—it can be a number of hours or days a year, such as 40 hours a year, or five days off for vacation.

That’s why we encourage you to consider all the variables described in the steps above, in addition to how much time you offer as PTO to your employees. And, consider whether full-time and part-time employees are eligible—and when. Once you determine your PTO accrual rate, you will need to plug that rate into your payroll software or provide it to your payroll service provider. Since hourly employees don’t work fixed or standard hours, you may want to determine their accrual rate per hour worked, rather than providing them a fixed number of hours per year, as an example.

Traditional Paid Time Off System

Unfortunately, due to a limitation with most HRIS and payroll platforms, employees are only “granted” the PTO that they’ve accrued when payroll actually runs. This means people often find themselves in the position of not being able to use time off they’ve earned when they actually need it. Employees earn the right to PTO based on the hours they work in a given period of time.

.jpeg)

.jpeg)

.jpeg)

.jpeg)